Entrepreneurs and Business Owners typically are action orientated and not ones for pouring over spreadsheets. There is a reason they did not become accountants. However, whether raising capital, or simply planning, there is a need and benefit to creating a coherent financial plan.

To help with this, we’ve released a Business Plan template that has been used in several startups to successfully raise capital and plan for the years ahead. Please feel free to use it and modify as you would like.

It’s available as a Google Drive spreadsheet, so can can take a copy and work on this collaboratively with your own team. Remember to set access permissions appropriately. You can also download this as Excel format if you prefer, and for Mac users, an Excel format file can still be opened in Numbers.

Complete the form below to download the template!

Many entrepreneurs get irked when asked to produce a financial plan, but there are reasons for this, despite the fact that it’s unfeasible to map out a course up to 5 years for a product you may not have even built yet.

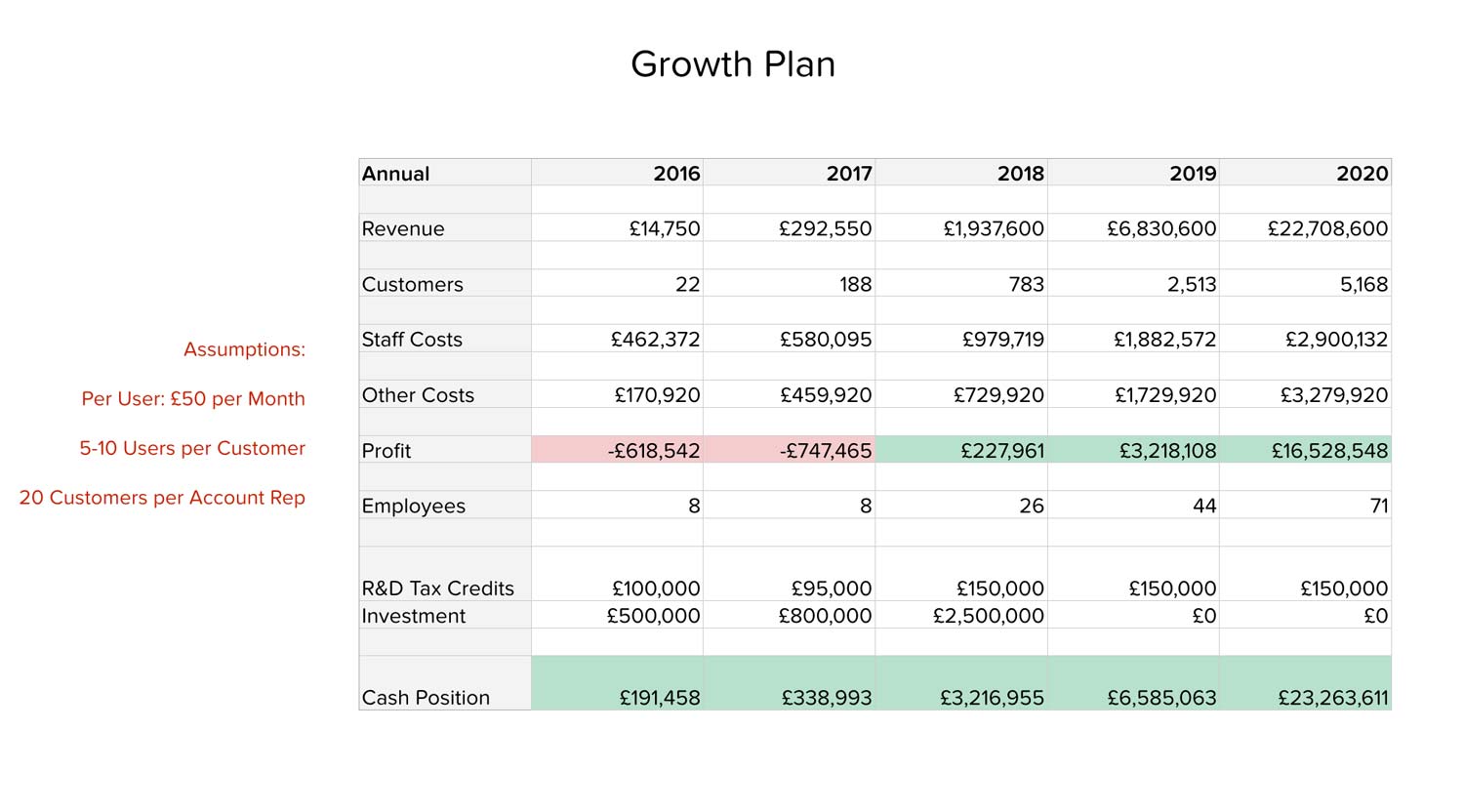

Investors use the plan to determine a number of things:

Can you drive a financial plan? If they are about to give you several million, they want to know you’ll be able to track it rather better than a collection of post-it notes.

Do you understand the links between spending and revenue? If your customer count doubles, then won’t you need more staff? If you double your staff, then do you need additional office space?

Does the plan “pencil out”. In other words, is there a believable path to a worthwhile investment? In simple terms, can you see a $100M valuation within 5 years? The critical assumptions here are things like cost of sale and market opportunity.

Whether or not you’re raising capital, reflecting on the above points is invaluable. It makes sense for you to put together a financial model even if bootstrapping as you need to keep a handle on costs and cashflow.

The template contains three parts. The main sheet is the monthly view. This is the most detailed view and covers all the main expense categories. It’s a common oversight to forget to add in inevitable legal costs of company setup, funding etc. Staff over the near term may be identifiable, but beyond that, it makes more sense to simply use a general employee count and average salary. As you can see in the template, we’ve added some identified employees at the beginning, swopping over to such a general count later.

The template is set up for sterling, but currency can be changed easily. Payroll tax is calculated as per the UK, which has a tax-free allowance, after which point a single tax rate is applied. The formula can be easily adapted to your local region.

The revenue model is based upon a SaaS (Software as a Service) business with recurring revenue.

Whilst the sample numbers are not miles away from reality, there has been no attempt to make this a “real” financial model. Obviously you should use your own numbers and assumptions. It’s a cash based template that makes no attempt to model revenue recognition or other accounting elements such as depreciation. For a startup, cash is critical, and your accounting system is the best place to generate the actual formal accounts for reporting to the relevant authorities.

Two other sheets are included, which respectively summarise the Quarterly and Annual pictures. These are linked and automatically update as you modify the base monthly view. The Annual picture is at a level appropriate to include in your funding presentation.